Gift Planning

Risky Stock Market Prompts Economist’s 5th Gift Annuity

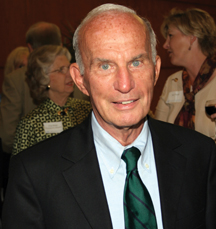

Charles (Chuck) Hammond Jr. knows something about corporate finance and economics and their effect on financial markets. He earned three degrees from the U of I: BS ’49, MS ’54 and Ph.D. ’58, in economics, and then spent the next 35 years as a loan officer and international economist with the Import-Export Bank of the United States. “My education at the University of Illinois provided me with the skills and knowledge needed to obtain a well-paying and satisfying career,” Chuck points out.

Charles (Chuck) Hammond Jr. knows something about corporate finance and economics and their effect on financial markets. He earned three degrees from the U of I: BS ’49, MS ’54 and Ph.D. ’58, in economics, and then spent the next 35 years as a loan officer and international economist with the Import-Export Bank of the United States. “My education at the University of Illinois provided me with the skills and knowledge needed to obtain a well-paying and satisfying career,” Chuck points out.

Now 85, he is like many investors in their retirement years, valuing safety, reliability and income, which are all benefits offered by the U of I Foundation’s charitable gift annuity (CGA) program. “It’s really a win-win situation, given the fact that I’m able to convert some of my stocks to a source of lifetime income without triggering the capital-gain tax,” Chuck observes. Additional benefits include immediate income-tax savings and much of his 8% lifetime annuity payment is taxed at the low 15% capital-gain rate, and part of it is even tax-free!

After his lifetime, the proceeds from his CGAs, as well as a large bequest, will establish the Charles Hammond Jr. Scholarship Fund. “When I graduated from high school, I was awarded the Van B. Eyerly Scholarship, which basically paid my expenses for all four years. It was remarkable to me that I was receiving such generosity from people I didn’t even know. I remember at the time that it sounded almost too good to be true,” he recalls.

Indeed, it was true, and Chuck Hammond made the most of the opportunity he was given and is now intent on “repaying” the favor. “I knew I wanted to give back for what I had received, so establishing a scholarship fund was the obvious solution.”

Then Chuck simply responded to a newsletter just like this one, and the process was under way to establish his legacy at the U of I. “I would encourage anyone with a desire to help the U of I to look into their CGA program. That’s what I did and now I have five of them … it really is a great way to give,” he concludes.

To inquire about establishing your own legacy, call or e-mail.

The U of I Foundation gift planning staff is pleased to answer your questions and offer assistance at any time. Please contact the Foundation to learn more.

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer